Planning a vacation rental can be exciting, but have you thought about what could go wrong? What if your booking gets canceled, or something unexpected happens during your stay?

You might think travel insurance is just for flights and hotels, but is it really a good idea for a vacation rental too? Understanding how travel insurance works for vacation rentals can save you stress, money, and disappointment. Keep reading to find out if protecting your rental is worth it and how it could make your trip worry-free.

Why Choose Travel Insurance For Vacation Rentals

Travel insurance helps protect your money and plans for vacation rentals. It covers unexpected problems that can happen before or during your trip.

Choosing travel insurance gives you peace of mind. You can enjoy your vacation without worrying about risks.

Protection Against Cancellation Costs

Sometimes plans change or emergencies happen. Travel insurance can refund your money if you must cancel your rental.

This coverage helps you avoid losing all your payment for the vacation rental.

Coverage For Property Damage

Accidents can cause damage to the rental property. Travel insurance may cover repair costs or damages you cause.

This can save you from paying large fees out of pocket after your stay.

Protection From Travel Delays

Flight delays or other travel issues can cause you to miss check-in times. Insurance can help cover extra costs from these delays.

You may get reimbursed for extra hotel nights or transportation expenses during the delay.

Medical Emergencies Coverage

If you get sick or injured during your rental stay, travel insurance can help pay medical bills.

This coverage is helpful if your regular health insurance does not cover you outside your home area.

Support For Lost Or Stolen Belongings

Travel insurance can cover your belongings if they are lost or stolen during the vacation.

This protection helps you replace important items like passports, electronics, or luggage.

Credit: www.insureyonder.com

Key Benefits Of Travel Insurance

Travel insurance can help protect your vacation rental plans. It covers unexpected problems that may arise before or during your trip.

Here are some important benefits of having travel insurance for a vacation rental.

Protection Against Booking Cancellations

Travel insurance often covers cancellations caused by illness, travel delays, or emergencies. This helps you get a refund if you cannot use your vacation rental.

Without insurance, you might lose the money paid for your booking if you cancel last minute.

Coverage For Property Damage

Insurance can protect you from paying large fees if you damage the rental property. It covers accidental damage like broken furniture or appliances.

This coverage gives peace of mind and helps avoid costly disputes with rental owners.

Liability Protection

Liability protection covers you if you accidentally injure someone or damage their property while staying at the rental.

It can help pay for legal fees or medical costs if a claim is made against you.

Emergency Medical Coverage

Travel insurance often includes emergency medical coverage. It pays for doctor visits, hospital stays, or emergency care during your trip.

This is important if your regular health plan does not cover you outside your home area.

Trip Interruption Benefits

Trip interruption coverage helps recover costs if your trip ends early due to emergencies. It may cover unused rental days and travel expenses to return home.

This benefit helps reduce financial loss from unexpected events like family emergencies or severe weather.

Common Risks Without Insurance

Traveling to a vacation rental can be fun and relaxing. But sometimes things go wrong. Without insurance, you might face big problems.

This section explains common risks when you do not have travel insurance for a vacation rental.

Loss Due To Cancellations Or Delays

Trips can be canceled or delayed for many reasons. Without insurance, you may lose the money paid for the rental.

Airline problems, personal emergencies, or natural disasters can cause cancellations or delays. Insurance can cover these losses.

- Flight cancellations or delays

- Sudden illness or injury

- Severe weather events

Unforeseen Property Issues

Sometimes the rental property has problems that you did not expect. Without insurance, you may have to pay for extra costs.

Issues like broken appliances, plumbing problems, or pest infestations can ruin your stay. Insurance can help cover alternative lodging or repairs.

- Heating or air conditioning failure

- Water leaks or electrical issues

- Unclean or unsafe conditions

Accidents And Injuries

Accidents can happen during your stay. Without insurance, you might face high medical bills or liability costs.

Injuries from slips, falls, or other incidents may require medical help. Insurance can cover treatment and protect you from legal claims.

- Slip and fall injuries

- Accidental damage to the property

- Medical expenses from accidents

Credit: www.nerdwallet.com

How To Choose The Right Policy

Travel insurance for a vacation rental can protect you from unexpected problems. Picking the right policy helps you avoid extra costs and stress.

Look closely at what each policy offers. This guide helps you find a plan that fits your needs and budget.

Evaluating Coverage Limits

Check the maximum amount the policy will pay for different issues. Coverage limits tell you how much money you can get back.

Make sure the limits cover the full cost of your rental and other expenses like medical bills or trip cancellations.

- Look for high enough limits to cover major risks

- Compare limits for property damage and theft

- Check if medical coverage suits your needs

Checking Policy Exclusions

Read the list of things the insurance will not cover. Exclusions can leave you without help in some cases.

Common exclusions include damage from pets, natural disasters, or pre-existing conditions. Know what is excluded before buying.

- Find out if certain damages or events are not covered

- Check if cancellations for specific reasons are excluded

- Look for any limits on coverage for valuables

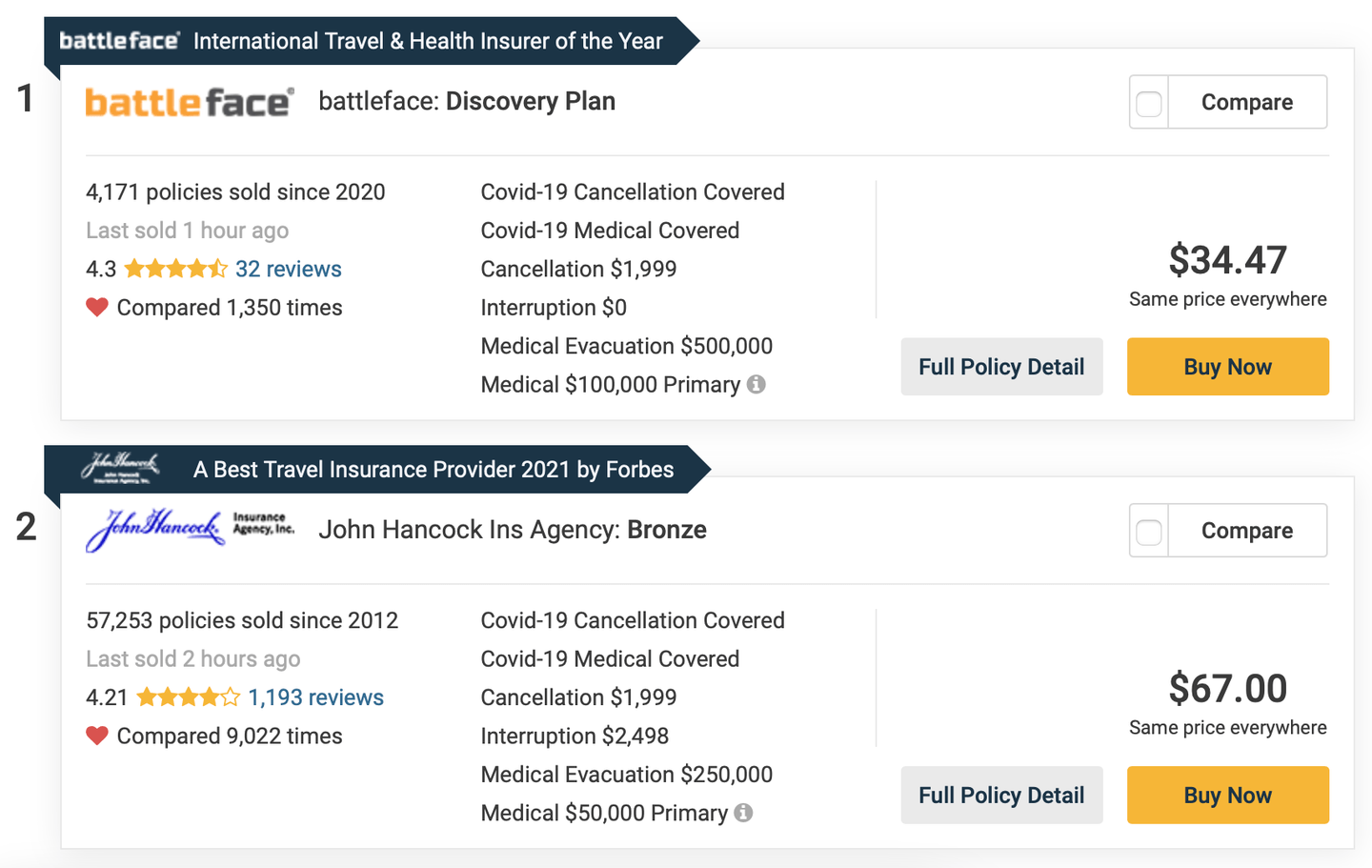

Comparing Provider Reputation

Choose an insurance company with a good reputation. Reliable providers pay claims quickly and answer questions well.

Check online reviews and ratings. Look for feedback on how they handle claims and customer service.

- Search for customer reviews on trusted websites

- Check how long the company has been in business

- Look for clear and simple claim processes

Tips For Filing Claims

Travel insurance can help protect your vacation rental plans. Knowing how to file claims correctly saves time. Follow these tips to make the process easier.

Being prepared and organized improves your chances of a smooth claim. Keep records and stay on top of deadlines.

Documenting Incidents

Write down what happened as soon as possible. Include dates, times, and details of the incident. Photos and videos can be helpful.

Keep all receipts and proof of any expenses related to the claim. This shows evidence to support your case.

- Take clear photos of damage or issues

- Save emails or messages with the rental owner

- Keep receipts for repairs or replacements

- Write a detailed incident report

Meeting Deadlines

Check your insurance policy for claim deadlines. Missing a deadline can cause your claim to be denied. Act quickly after an incident.

Set reminders to submit your claim and any needed documents on time. Keep track of all submission dates.

- Note the claim filing deadline from your policy

- Send documents before the due date

- Follow up if you do not get a response

- Keep copies of everything you submit

Communicating With Providers

Talk clearly and politely with your insurance provider. Ask questions if you do not understand the process. Keep all conversations professional.

Write down names, dates, and details of your calls or emails. This helps track your claim progress.

- Use email for written proof of communication

- Record the names of people you speak to

- Clarify what documents are needed

- Respond promptly to any requests

Credit: www.acg.aaa.com

Frequently Asked Questions

What Does Travel Insurance For Vacation Rentals Cover?

Travel insurance for vacation rentals covers trip cancellations, property damage, and liability claims. It also protects against theft and natural disasters. This insurance ensures financial protection if unexpected events disrupt your stay. Always check your policy details for specific coverage limits and exclusions.

Is Travel Insurance Necessary For Every Vacation Rental?

Travel insurance is highly recommended for vacation rentals, especially if prepaying or booking far in advance. It protects your investment against cancellations and emergencies. However, if the rental includes comprehensive protection, you might not need additional insurance. Evaluate risks before deciding.

Can Travel Insurance Refund Canceled Vacation Rental Bookings?

Yes, travel insurance often refunds non-refundable vacation rental deposits if cancellation reasons are covered. Covered reasons include illness, travel bans, or emergencies. Policies vary, so review terms carefully to understand refund conditions and claim processes.

How Does Travel Insurance Protect Against Vacation Rental Damages?

Travel insurance can cover accidental damages caused during your stay. It helps pay for repairs or replacements without dipping into your savings. Always document the rental condition before arrival to avoid disputes. Confirm if damage protection is included in your plan.

Conclusion

Travel insurance for vacation rentals? Definitely worth considering. It offers peace of mind. Protects against unexpected cancellations. Covers medical emergencies during trips. Safeguards personal belongings. Travel plans can change suddenly. Insurance helps avoid financial stress. It’s an affordable way to secure your trip.

Increases confidence while traveling. Allows you to focus on enjoyment. Less worry, more fun. Always review policy details carefully. Know what’s covered and what’s not. Make informed decisions for a stress-free vacation. Enjoy your travels with added protection.